SVB the Iceberg in the Global Financial Meltdown Coming!

Submitted by Dave Hodges on Sunday, March 12, 2023 - 22:41.

- The Ecnomic Truth

So we've all heard that Silicone Valley Bank has failed, and it's put into FDIC receivership. The FDIC holds about $129B in assets in their insurance fund. SVB, as per their December 2022, held $173B on their balance sheet. The issues started with a bank run where they had to sell their treasuries to cover asset flight from bank deposits. The problem is that the treasuries are being sold at a loss due to rising bond rates. Most likely, Bailins are coming to SVB.

SVB Stock is down 60% overnight.

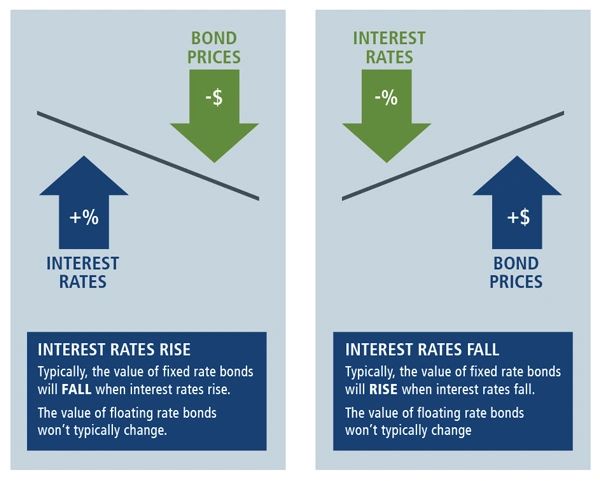

How bonds lose value: