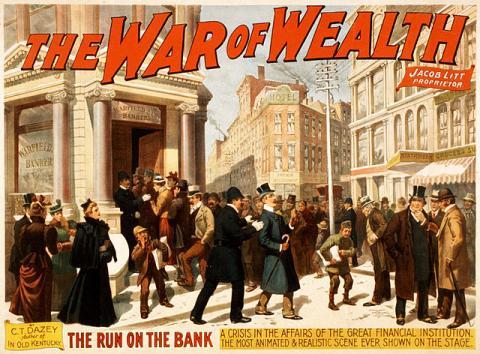

America's Biggest Banks Experience Massive Withdrawals

NTD

Between the collapse of SVB over March 10 weekend and March 22, domestically chartered banks in the United States lost a total of roughly $213 billion in deposits as skittish savers rushed to withdraw their money, according to the latest seasonally adjusted Federal Reserve figures on deposit outflows.

But while the first week following the failure of SVB saw a record drop of $196.4 billion in deposits in smaller banks—defined as ones smaller than the top 25 in terms of assets—the latest week saw a reversal.

Small domestically chartered banks saw an increase of roughly $6 billion in the past week. Still, the latest figures show that smaller banks remain down just over $190 billion since the collapse of SVB sent shockwaves across markets.

Big banks, meanwhile, which saw an increase in deposits in the week following the SVB failure, saw a sharp decline last week. Deposits at large domestically chartered banks dropped by $89.7 billion in the week ended March 22. A week prior, big banks gained $67 billion in deposits. The latest data show that large U.S. banks are down $22.7 billion since the SVB collapse.

Money market funds have been among the major beneficiaries of the deposit outflows. Around $286 billion has flooded into U.S. money market funds so far in March, the Financial Times reported, citing EPFR data. That’s the biggest month of inflows since the height of the COVID-19 pandemic in 2020.

The failure of SVB, which had roughly $212 billion in assets for the final quarter of 2022, was the second largest bank collapse in U.S. history.